8 4 3 Rule in Mutual Fund SIP !

The 8-4-3 rule stands as a strategic approach to investment, capitalizing on the compounding phenomenon to expedite the accumulation of wealth. By delving into meticulous calculations, one can grasp its mechanics, thereby leveraging it to accomplish financial objectives and amass substantial wealth, potentially reaching multimillion figures.

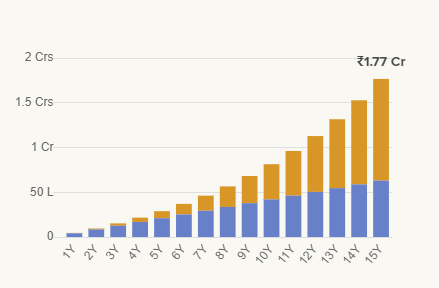

In this strategy, the trajectory of a particular investment’s average return unfolds over distinct timeframes. Initially, over an 8-year period, the investment yields a consistent 12% annual return. Subsequently, this rate of return is maintained over a shorter period of 4 years, halving the initial horizon to achieve the same percentage return. Further, in the subsequent 3 years, extending the total timeframe to 15 years, the corpus undergoes a doubling effect.

The complexity of investing for the future is simplified through systematic investment plans (SIPs), lauded for their straightforwardness and long-term wealth-building capabilities. However, in a market environment characterized by unpredictability, the importance of having a well-defined plan cannot be overstated. Herein lies the significance of the 8-4-3 rule, serving as an easily understandable blueprint that enhances the efficacy of SIPs.

At the heart of this strategy lies the potent force of compounding, a fundamental principle capable of significantly augmenting investment growth in mutual funds over time. Compounding entails not only earning returns on the initial investment but also on the accumulated returns from preceding periods. This compounding effect gains momentum with time, especially when investments are nurtured over extended durations.

As returns accrue from mutual fund investments, they are reinvested alongside the principal amount, resulting in future returns being calculated not just on the initial investment but also on the reinvested returns. This compounding process fosters exponential growth in the investment’s value, underscoring the importance of prolonged investment tenure.

The 8-4-3 rule epitomizes the magic of compounding in mutual funds. Over the initial 8 years, the compounding effect yields promising outcomes, with its velocity intensifying in the subsequent 4 years and escalating even further in the ensuing 3 years, exhibiting an exponential growth pattern.

Illustratively, a monthly investment of Rs. 35,000, generating a 12% annual return, showcases the fascinating progression of portfolio value. Over the initial 8 years, the portfolio reaches the first Rs. 55 lakhs, reflecting the patience required for compounding to manifest its efficacy. Subsequently, the timeframe shrinks to 4 years for the second Rs. 55 lakhs, followed by a swift 3 years for the third Rs. 55 lakhs, elucidating compounding’s profound power.

In essence, the 8-4-3 rule underscores the significance of compounding and disciplined investing, offering a tangible demonstration of their transformative potential.

Below is the illustration of return on investment with Rs.35000 monthly SIP assuming 12% return.