EPF (Employee Provident Fund) and PPF (Public Provident Fund) are both popular investment options in India aimed at providing financial security and retirement benefits to individuals. While they share similarities, they also have distinct features. Lets understand this in detailed.

EPF (Employee Provident Fund): What is EPF ?

EPF stands for Employee Provident Fund. It is a retirement savings scheme in India that is managed by the Employees’ Provident Fund Organisation (EPFO), which operates under the authority of the Ministry of Labour and Employment, Government of India. The EPF scheme is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.EPF serves as a social security measure to provide financial stability and retirement benefits to employees. Both employers and employees contribute a portion of the employee’s salary to the EPF account, which accumulates over the years of employment. The funds in the EPF account are invested in various financial instruments such as government securities, bonds, and fixed deposits to generate returns.

Purpose: EPF is a mandatory savings scheme for employees in India. It is managed by the Employees’ Provident Fund Organisation (EPFO) and is governed by the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

Contributors: Contributions are made by both the employee and the employer. A portion of the employee’s salary, typically 12%, is deducted towards EPF, and the employer also contributes an equal amount.

Interest Rate: The EPF interest rate is set by the government and is subject to change every year. Historically, it has been relatively competitive compared to other fixed-income investment options.

Tax Benefits: Contributions made towards EPF are eligible for tax deductions under Section 80C of the Income Tax Act, subject to certain conditions. Additionally, interest earned and withdrawals from EPF are generally tax-exempt under specified conditions.

Withdrawal: EPF allows partial withdrawals for specific purposes like buying a house, medical emergencies, marriage, etc. Full withdrawal is allowed upon retirement or after a certain period of unemployment.

Portability: EPF is portable across jobs, meaning the account remains active even if the employee changes jobs. The accumulated balance can be transferred to the new employer’s EPF account.

PPF (Public Provident Fund): What is PPF

PPF stands for Public Provident Fund. It is a long-term savings scheme offered by the Government of India, aimed at providing financial security and retirement benefits to individuals. The PPF scheme is governed by the Public Provident Fund Act, 1968, and it is managed by designated banks and post offices across India.

Purpose: PPF is a voluntary long-term savings scheme offered by the Government of India. It is aimed at providing financial security and retirement benefits to individuals. PPF is governed by the Public Provident Fund Act, 1968.

Contributors: Individuals can open a PPF account with designated banks or post offices. Contributions are made by the individual account holder. There are no employer contributions in PPF.

Interest Rate: The PPF interest rate is also set by the government and is subject to change every quarter. Historically, it has been relatively higher compared to other fixed-income instruments.

Tax Benefits: Contributions made towards PPF are eligible for tax deductions under Section 80C of the Income Tax Act. Furthermore, the interest earned and withdrawals from a PPF account are tax-free.

Withdrawal: PPF has a lock-in period of 15 years, after which the account holder can make partial withdrawals or opt for full closure. Partial withdrawals are allowed from the 7th financial year onwards.

Portability: PPF accounts are not job-specific and can be continued even if the individual changes jobs or employment status. The account remains active until it is closed by the account holder.

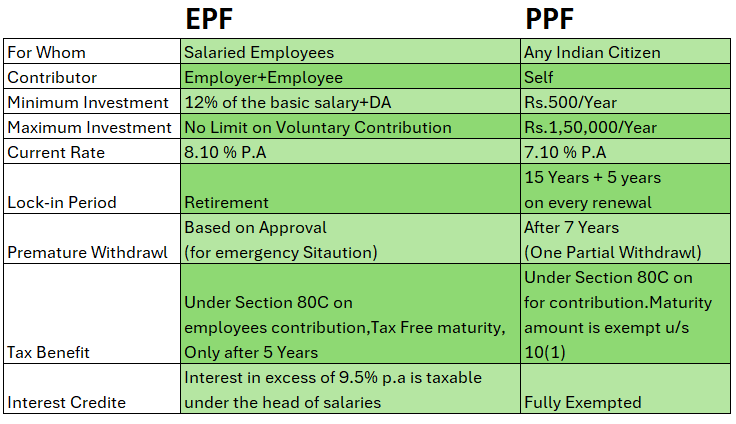

Difference between EPF and PPF:

Mandatory vs. Voluntary: EPF is mandatory for employees covered under the EPF Act, whereas PPF is voluntary and can be opened by any individual.

Contributors: EPF involves contributions from both the employee and the employer, while PPF involves contributions only from the individual account holder.

Employer Involvement: EPF is administered by the employer through salary deductions, while PPF is managed directly by the individual account holder.

Interest Rates: Although both schemes offer attractive interest rates, the rates may vary, and they are decided by the government separately for EPF and PPF.

Withdrawal Flexibility: EPF allows partial withdrawals for specific purposes even before retirement, whereas PPF has a longer lock-in period of 15 years, with partial withdrawals allowed from the 7th year onwards.

Portability: EPF accounts are linked to employment and are transferable between jobs, while PPF accounts are not job-specific and can be continued regardless of employment status.

In summary, while both EPF and PPF aim to provide financial security and retirement benefits, they differ in terms of contribution structure, employer involvement, withdrawal flexibility, and portability. Individuals often utilize both EPF and PPF to diversify their retirement savings and enjoy tax benefits.

EPF & VPF Calculator

EPF & PPF Calculator

| EPF Calculator | PPF Calculator | |

|---|---|---|

|

12% 3.67%

Total Employee EPF Contribution: ₹0 Total Employer EPF Contribution: ₹0 Total Return: ₹0 |

7.1%

Total PPF Amount: ₹0 |