In a world where managing finances can feel overwhelming, the 50:30:20 rule offers a simple, effective framework to help individuals achieve financial stability and long-term goals. This budgeting strategy divides income into three broad categories—needs, wants, and savings—giving people a clear roadmap to manage their money in a balanced and sustainable way. Whether you are just starting your financial journey or looking to regain control over your finances, understanding and applying the 50:30:20 rule can set you on the path to success.

What is the 50:30:20 Rule?

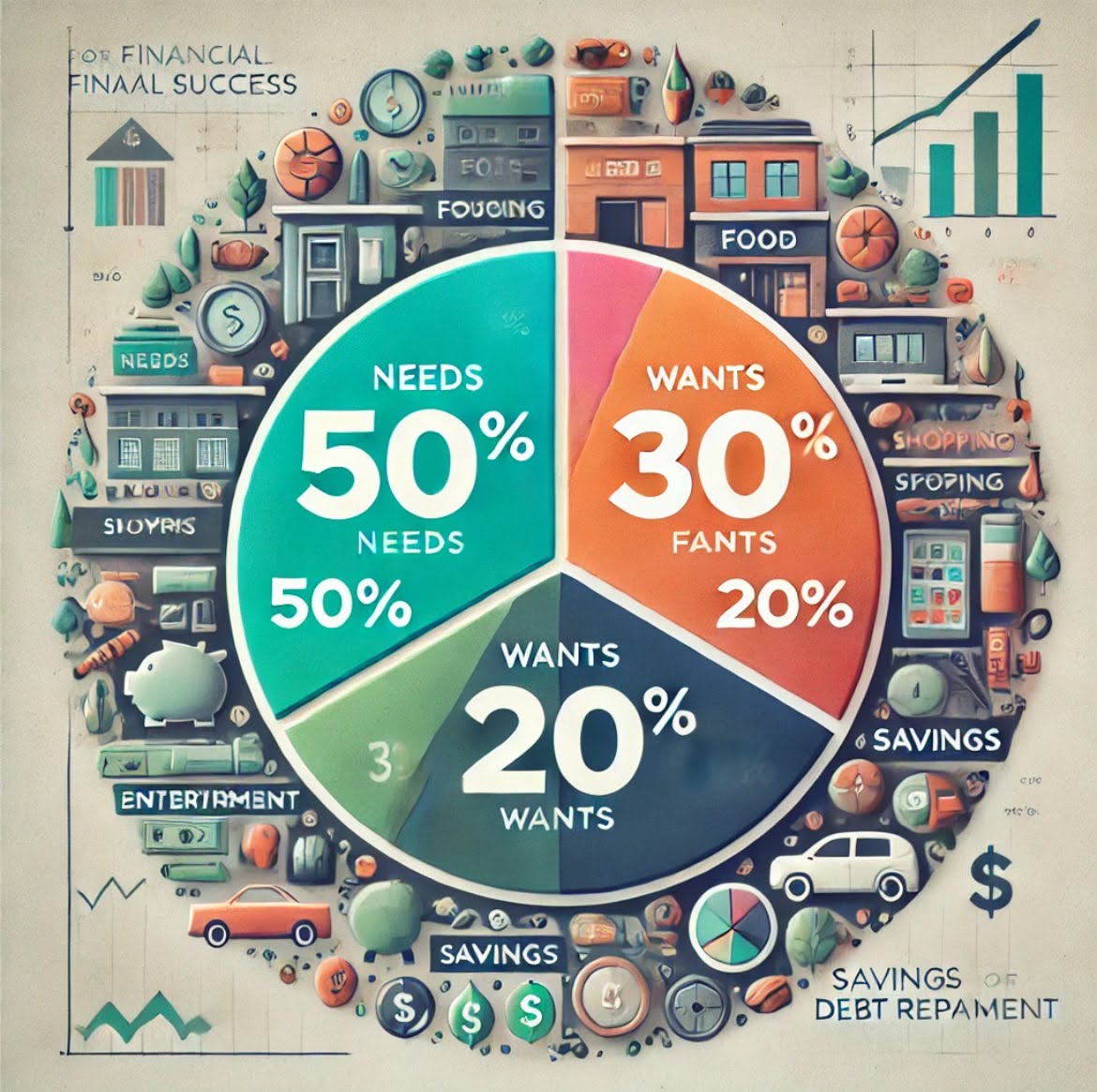

The 50:30:20 rule is a straightforward budgeting guideline that helps you allocate your income into three essential areas:

- 50% for Needs: Half of your income should go toward covering essential expenses or “needs.” These are necessary costs that you cannot avoid, such as rent or mortgage payments, utilities, groceries, transportation, insurance, and basic healthcare. Needs represent the foundational costs of living, and ensuring that these are covered within 50% of your income provides a solid financial base.

- 30% for Wants: The next 30% of your income should be dedicated to “wants.” These are non-essential expenses that bring enjoyment and comfort to your life but are not required for basic survival. Wants might include dining out, entertainment, travel, hobbies, and new clothes. It’s important to distinguish between needs and wants to ensure you’re not overspending in this category.

- 20% for Savings and Debt Repayment: Finally, 20% of your income should be allocated to savings and paying off debts. This category includes contributions to an emergency fund, retirement accounts, and any investments. If you have outstanding debts, such as credit card balances or student loans, a portion of this 20% should go toward repaying them. Building long-term financial security through savings and reducing debt is crucial for achieving financial independence.

Why the 50:30:20 Rule Works

The beauty of the 50:30:20 rule lies in its simplicity. Instead of getting bogged down by complicated budgets or detailed expense tracking, this rule provides a clear structure that is easy to implement and maintain. It is flexible enough to adapt to most financial situations, while also ensuring that you are living within your means, enjoying life, and preparing for the future.

Here’s why the 50:30:20 rule is so effective:

- Balanced Approach: The rule strikes a healthy balance between living for today and saving for tomorrow. It ensures that you are covering your essential expenses, but still have room to enjoy your life and treat yourself. At the same time, it emphasizes the importance of saving and debt reduction, which are key to long-term financial well-being.

- Reduces Financial Stress: Many people feel stressed about money because they lack a clear plan. The 50:30:20 rule provides structure, which can reduce financial anxiety. When you know exactly how much of your income goes to each category, you gain a sense of control over your finances. This clarity can help reduce impulsive spending and improve overall financial discipline.

- Promotes Long-Term Savings: By allocating 20% of your income to savings and debt repayment, the 50:30:20 rule ensures that you are actively working toward financial goals, such as building an emergency fund, saving for retirement, or paying down high-interest debt. This long-term focus is crucial for avoiding financial setbacks and building wealth over time.

- Flexibility: The rule is not rigid—it’s a framework that can be adjusted based on individual circumstances. If you live in an expensive city where housing costs take up more than 50% of your income, you may need to make adjustments to other categories. Similarly, if you are aggressively paying off debt, you might allocate more than 20% toward savings and debt repayment for a short period. The key is to maintain balance and ensure that one category is not overwhelming the others in the long term.

How to Implement the 50:30:20 Rule

If you’re ready to implement the 50:30:20 rule, follow these simple steps:

- Calculate Your After-Tax Income: The first step is determining your after-tax income, which is the amount you have left after taxes are deducted from your paycheck. If you are self-employed, remember to subtract business expenses and taxes from your total earnings to find your usable income.

- Break Down Your Expenses: Review your monthly expenses and categorize them into “needs,” “wants,” and “savings/debt repayment.” If you’re unsure where your money is going, tracking your expenses for a month or two can be a helpful exercise. For each category, calculate how much you are currently spending as a percentage of your income. This will give you a clear picture of whether you need to make adjustments to align with the 50:30:20 rule.

- Adjust Your Spending: If you find that you are spending more than 50% on needs or more than 30% on wants, you may need to make changes to bring your budget in line. This could mean cutting back on non-essential spending, finding ways to reduce essential expenses, or boosting your income with a side hustle or part-time work.

- Automate Your Savings: To make saving easier, consider automating the process. Set up automatic transfers from your checking account to a savings or investment account, so that the 20% allocated for savings and debt repayment is taken care of without needing to think about it. This “pay yourself first” approach makes it more likely that you’ll consistently save for future goals.

- Reassess Periodically: Your financial situation may change over time, so it’s important to review your budget and spending habits regularly. Life events such as moving, getting a new job, or having children can impact your financial priorities. Reassessing your budget ensures that the 50:30:20 rule continues to serve your needs as your circumstances evolve.

Common Challenges and How to Overcome Them

While the 50:30:20 rule is straightforward, some people may face challenges when trying to implement it. Here are a few common obstacles and tips for overcoming them:

- High Living Costs: In some areas, particularly in expensive cities, rent or mortgage payments may exceed the 50% guideline for needs. If this is the case, you may need to adjust the rule temporarily by reducing the percentage spent on wants or increasing your income through a side hustle. The key is to ensure that, overall, your budget is balanced.

- Variable Income: For freelancers, gig workers, or those with irregular income, sticking to a fixed budget can be tricky. In these cases, it’s helpful to base your budget on your average monthly income or a conservative estimate. During months where you earn more, consider saving extra to account for months when your income is lower.

- Paying Off Debt: If you are aggressively paying off debt, such as credit card balances or student loans, you may need to allocate more than 20% of your income toward debt repayment. In this case, temporarily reducing spending in the wants category can help you pay off debt faster, allowing you to return to the 50:30:20 rule once your debt is under control.

Conclusion

The 50:30:20 rule is a simple yet powerful tool for managing your finances. By dividing your income into three main categories—needs, wants, and savings—it offers a balanced approach to budgeting that helps you cover essential expenses, enjoy life, and build a secure financial future. Whether you’re just starting to budget or looking for a fresh approach to managing your money, the 50:30:20 rule can provide the structure you need to achieve financial success.